Brown University and the middle class, glass ceiling

Many students and families struggle between the expensive price tag of Ivy League colleges and the benefits of those schools.

When I read the first ‘c’ in ‘congratulations’, I threw my laptop into the air and spread my arms out-wide, airplane style, like I had just won the World Cup with a single click. Brown admitted me. My dream school actually wanted me to live the dream. All of the late nights at the library, McDonalds when the library closed (where I am writing this currently), and then Dunkin Donuts after McDonalds closed were worth it. I never realized a single word could make me smile for four days straight, to shiver at random moments and stare at my hand to confirm that I was actually alive. That those were my eyes reading that single word.

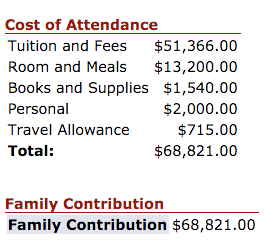

But later that week a read an equally staggering number: $68,821. Brown’s expected contribution from my family and I, even after applying for financial aid, was beyond comprehension. My family does well for itself, but there was no $280,000 savings account with my name on it. Even if I were to bring prospective students and parents to tears, giving admission tours as a student employee, while simultaneously creating beautiful latte art at a hipster coffee shop, there was no way I was going to pay off the cost. After haggling and begging with Brown financial aid staff, I would be at least $90,000 in debt if I were to attend my dream school. A newly dream-crushing dream school. I never realized a number can make you twitch in bed. Make you reconsider everything you worked towards. I never realized a lone number can make you tear up.

In eighth grade, my parents and I toured Harvard while my older brother looked at other colleges in the area. The tour was almost a joke. I was the ‘smart’ one of the four of us and Harvard was where the geniuses were. After playfully wandering around Harvard yard, I ironically bought an erroneously priced t-shirt. I pulled that shirt on with pride and bought into the American dream. I believed that if I studied hard enough, put in the hours and effort outside the classroom and in it, I could go anywhere. Money was an afterthought, but a thought I should have considered from the very beginning.

Being in the perfectly terrible position of not qualifying for enough federal aid, but not being a trust-fund baby either, I didn’t see the middle class, glass ceiling. In an article for The Brown Daily Herald, even the Brown Dean of Admissions said, “We do a good job with low-income students, but I think we’re all concerned about the pressures on middle-class families.”

The journal Sociology of Education studied 9,000 college students and the debt they inherited. They found that students from the top socioeconomic status usually had parents who had anticipated college costs effectively and saved beforehand, and low-income students qualified for grants and federal aid. While the students from middle-income families took on the most debt in any category. The average graduate from the class of 2015 taking on $35,000 in debt. In my case, I would join the 1.1 million Americans with over $100,000 in debt by the time I graduate.

I stayed up late reading horror stories of people holding off marriage, buying a home, and starting a family due to student debt. I started hitting the gym so I could sign my life away to ROTC. I went to my school’s job fair to possibly start the long treadmill of jobs leading to financial freedom. That number, if I were to accept it, would change my life forever.

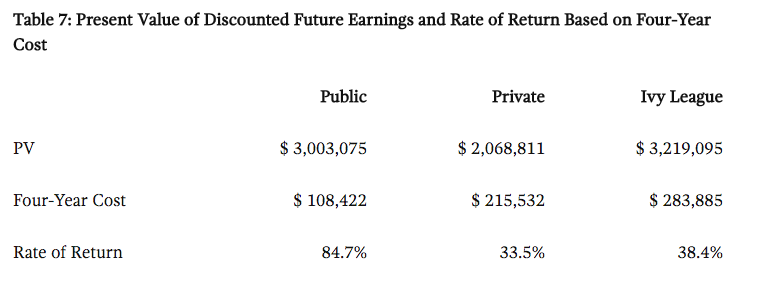

The real question became: Is an Ivy league education worth the $280,000 price tag? Frank Bruni, New York Times columnist and author of Where You Go Is Not Who You’ll Be says that many successful CEOs, politicians, and industry influencers have come out of the state school system. And studies have shown that students admitted to the Ivy league, but who then defer enrollment are equally successful (financially speaking) as those who graduated from them. Financially speaking, Investopedia says the average public institution has a higher ROI than the full cost of the Ivy League.

But others like Samuel Goldman, professor of political theory at Washington University, believes the Ivy League provides a network unmatched by the state university system. The peers at competitive institutions drive you to push your boundaries. The name brand of the institution also has sway at top-tier consulting and investment firms who only hire from a select number of schools.

As juniors and their parents begin to seriously consider their college options, have an open conversation about what you value in a college education and what your family is able to afford. Realize that though the Ivy league is an amazing opportunity, it may not be one worth taking.

***Personal side note*** After talking with friends and family and days of consideration, I am not going to Brown. I intend to be a part of Barrett, the Honors College at Arizona State University on a full-tuition scholarship.